How Is Credit score Administration Defined?

Credit score Administration Company (CMC) is a safe and fully-compliant company made up of expert and skilled teams. Basic Operate: The credit score manager position is accountable for your complete credit score granting process, including the consistent application of a credit coverage, periodic credit critiques of existing customers, and the evaluation of the creditworthiness of potential clients, with the purpose of optimizing the mix of company gross sales and unhealthy debt losses.

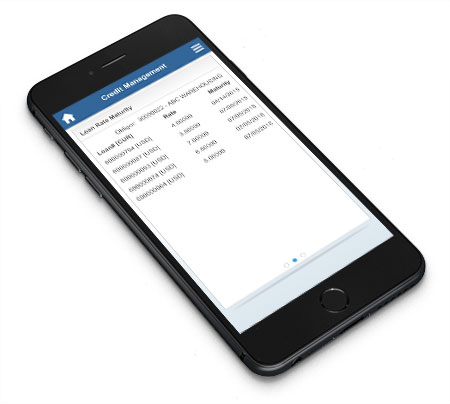

By mechanically integrating the debt collections within the process, the proportion of non-paying current customers also decreases. Give your staff the communication and customer service abilities they need to enhance money circulation and keep buyer relations. Uncollected payments are a monetary burden – in additional methods than you suppose. Cforia Software’s Credit score Administration Automation leverages fee pattern info that is locked within your accounting system to alert when a customer is in danger.

It is usually important to balance the pace of the debt assortment with an obligation-of-care that protects your repute, educates your buyer to respect your credit phrases, and makes your buyer conscious that protracted default will harm their credit standing. CMS3000 Credit Administration may also be built-in to other third get together reserving and accounts methods. Right DCA can help with Commercial and Client collections, each national and worldwide, what’s most necessary is that you’re getting the suitable outcomes for your business, enhancing your cash circulate and in the end the growth of what you are promoting.

Getting it proper reinforces the company’s monetary or liquidity place, making it a essential element in any enterprise. It represents the application in apply of a business strategy and administration of buyer credit outlined by the path of the company. Objective: This module is intended for students who work or plan to work in monetary institutions or credit score departments of private companies and who’ve an curiosity in credit score danger administration.

When it comes to credit restore and decreasing debt, they will price range to avoid wasting $5,000 per yr to repay debts. When a lender doesn’t obtain cost on an account for a particular amount of time, they may decide to close your account and turn it over to collections. Routinely linking credit data decreases the percentage of non-paying new prospects.