Monetary Accounting Manager Wage

With the move to IFRS for most of the world’s public companies and the far-reaching mandates of Sarbanes-Oxley, monetary accounting has change into a lot more sophisticated. This may contain anything from basic e-book-conserving to managing steadiness sheets and revenue statements. This represents the quantity of capital that is still within the business after its belongings are used to repay its excellent liabilities. Due to this fact, accountants have agreed to use a common set of measurement rules (a common language) to record information for monetary statements.

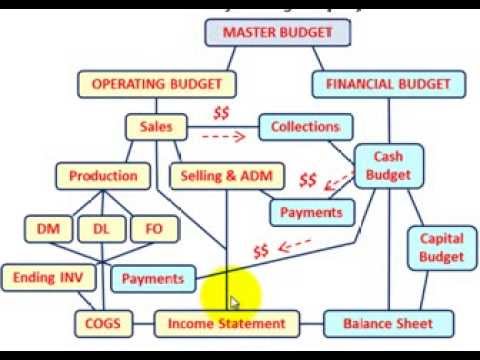

Financial accounting ends in the dedication of net earnings on the backside of the income statement. All through most of this century the assurance has been based on a system of inner controls and an audit of the printed financial statements. Students perform economics-based evaluation of accounting information from the perspective of the users of accounting information (especially senior managers) quite than the preparer (the accountant).

Other less-used components of the financial statements are the assertion of cash flows, the statement of retained earnings, and numerous accompanying disclosures. The members of FASAC are drawn from the ranks of CEOs, CFOs, senior companions of public accounting corporations, government directors of professional organizations, and senior …